/ Prof. Dr. Rui Mata & Alexandra Bagaini, MSc

Financial Decisions and Ageing

As we become older, we gain financial experience and knowledge but also may have trouble memorizing and learning new information. To what extent do such changes lead us to making “better” or “worse” financial decisions? The SNF-Sinergia project aims to help us answer these questions.

With populations becoming older, retirement being delayed and increasing pressure on public pensions systems, now more than ever, people of all ages need to manage their own finances to ensure present and future financial well-being. Yet, this is not an easy task as financial decisions are often complex and involve considerable amounts of knowledge and integrating multiple pieces of information

The consequences of certain financial investment “mistakes” can be more severe for older than younger adults due to the greater amount of wealth at stake and the more restrained ability to “bounce-back” for older individuals. Understanding how and why the quality of our investment decisions changes over the life course can help setup age-friendly financial strategies that are tailored to the goals and risks faced by different age groups.

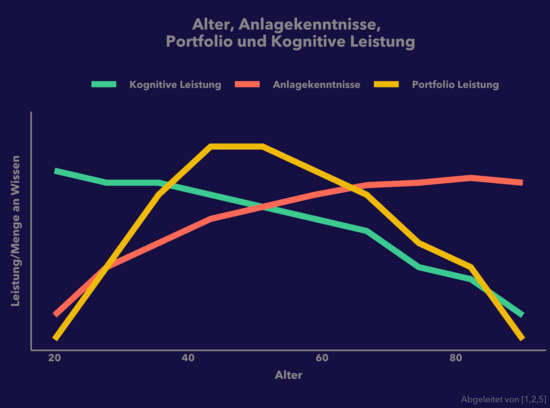

Past work that has analyzed brokerage account data suggests that older adults tend to have greater trading experience than younger adults, and thus have portfolios that demonstrate better investment knowledge: they hold more diversified portfolios, hold mutual funds with lower expense ratios and own more foreign stocks [1].

Yet, other research suggests that the older adults do not always make sound financial choices and that over the course of the lifetime, portfolio performance tends to follow an inverted U-shape, peaking around the age of 40 [2]. One possible explanation for this decline is related to age-related decline in cognitive abilities, such as the ability to hold multiple pieces of information actively in memory, which may play an important role in financial decision-making [3].

The patterns identified in past literature refer to population averages but work by Prof. Dr. Rui Mata and Prof. Dr. Joerg Rieskamp suggests there are large individual differences in decision-making strategies and performance across the life span [4]. The SNF-Sinergia project hopes to provide insight into why some people do better than others and investigate the role of the specific factors that make some individual succeed financially across their lives, including investigating the role of cognitive abilities, financial knowledge, and the type of financial strategies and advice followed.

[1] Korniotis, G. M., & Kumar, A. (2011). Do older investors make better investment decisions?. The Review of Economics and Statistics, 93(1), 244-265.

[2]Agarwal, S., Driscoll, J. C., Gabaix, X., & Laibson, D. (2009). The age of reason: Financial decisions over the life cycle and implications for regulation. Brookings Papers on Economic Activity, 2009(2), 51-117.

[3] Gamble, K., Boyle, P., Yu, L., & Bennett, D. (2015). Aging and Financial Decision Making. Management science, 61(11), 2603–2610.

[4] Mata, R., Schooler, L. J., & Rieskamp, J. (2007). The aging decision maker: Cognitive aging and the adaptive selection of decision strategies. Psychology and Aging, 22(4), 796–810.

[5] Michaud, P. (2017).The value of financial literacy and financial education for workers. IZA World of Labor 2017: 400