/ Alexandra Bagaïni, MSc, Prof. Dr. Rui Mata

Risk Preferences and Age: Insights from Psychology

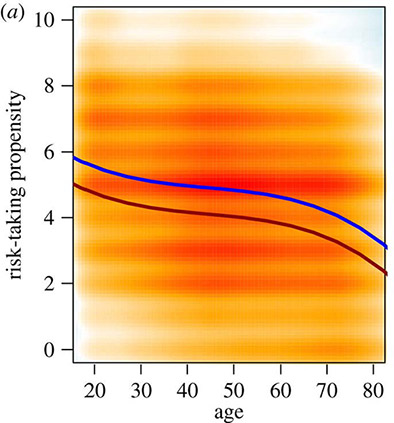

On average, older adults seem to take less risks than younger adults. However, there is considerable variation between people and still little is known why some individuals are willing to take risks well into old age. The SNF-Sinergia project contributes to clarifying the causes underlying individual and age differences in risk preference in the financial domain.

Almost everywhere around the world, older individuals seem to prefer taking fewer risks relative to younger adults [1]. However, despite these average patterns suggesting a decrease in the willingness to take risks with age, there are considerable individual differences and variation across domains, such as health, social, or financial domains [2]. Consequently, it is important not only to understand average patterns across age but also the factors that lead to some individuals pursuing risky activities in specific domains, such as financial investment.

Past work on individual and age differences in financial decision making, suggest that task characteristics, such as the learning and memory demands posed by financial decision can play an important role in successful financial choices [3]. Consequently, age differences in risky choice are most evident when decision makers are faced with many pieces of information or have to learn about financial options over time [3].

The SNF-Sinergia project aims to contribute to uncovering the role of several factors to individual differences in financial decision, including cognitive abilities, but also other important factors, such as financial knowledge, and individuals’ appetite for risk. We believe that as increasingly more weight is being put on individual investment decisions across the life span, it is important to understand individual choices so we can further personalize investment strategies.

[1] Mata, R., Josef, A. K., & Hertwig, R. (2016). Propensity for risk taking across the life span and around the globe. Psychological Science, 27(2), 231–243. http://doi.org/10.1177/0956797615617811

[2] Josef, A. K., Richter, D., Wagner, G. G., Hertwig, R., Mata, R., & Samanez-Larkin, G. R. (2016). Stability and change in risk-taking propensity across the adult life span. Journal of Personality and Social Psychology, 111(3), 430-450.

[3] Mata, R., Josef, A. K., Samanez‐Larkin, G. R., & Hertwig, R. (2011). Age differences in risky choice: a meta‐analysis. Annals of the New York Academy of Sciences, 1(1235), 18-29.

[4] Hertwig, R., Wulff, D. U., & Mata, R. (2019). Three gaps and what they may mean for risk preference. Philosophical Transactions of the Royal Society B: Biological Sciences, 374(1766), 20180140–10. http://doi.org/10.1098/rstb.2018.0140